Award-winning PDF software

Texas franchise tax report forms for 2013

Sales Tax Exemptions – Special District (PDF) , EZ Computation Report — ANNUAL (PDF): B1, New Orleans (PDF) , Sales Tax Exemptions – Special District (PDF): B4, Greater New Orleans (PDF) 5-169-C1, Sales Tax Exemptions – Concessions (PDF): C1 for the Concessions district; C2 for the Commercial district: For more information on the Concessions district please refer to 5-169-C4, Sales tax-exempt sales to nonresidents (PDF): C4 for businesses, nonprofits, charitable organizations, and governmental organizations. The following is a list of the state's four sales tax districts (B1, B2, C1, C4) and the tax rate. Please note that these rates are for the tax rate paid, not the total amount. These rates are subject to change as the law changes. Statewide: Sales (B1) – Sales and use tax applies to retail sales items 150 or less Sales and use tax (B2) – Business sales taxes apply to retail sales items that are.

Texas sales and use tax forms

They can also be customized to handle different types of sales in different locations using the same reporting template. Other Resources: The following websites and resources are especially helpful to Texans, including retailers, restaurants, food service establishments, food processors and distributors, restaurants, caterers, food manufacturers, food processors and distributors, food wholesalers, agricultural producers, farmers and ranchers, food manufacturers, food distribution businesses and distributors of food and agriculture: Department of Community Affairs Department of Economic Development & Tourism Department of Insurance Department of Revenue Department of Housing & Community Affairs Department of Health & Human Services (HIGHS) Department of Public Safety (DPS) Department of Transportation State Agriculture Commission Texas Department of Licensing and Regulation State Department of Education (SDE) Texas State Toll Highway Authority Texas Department of Transportation (DOT) Texas Department of Public Safety (DPS) Texas Department of Agriculture (DID) The Texas Department of Transportation (DOT) provides tax collection services through State Highway Patrol (SHP) troopers, toll road inspectors and construction inspectors. Texas Department of Licensing and.

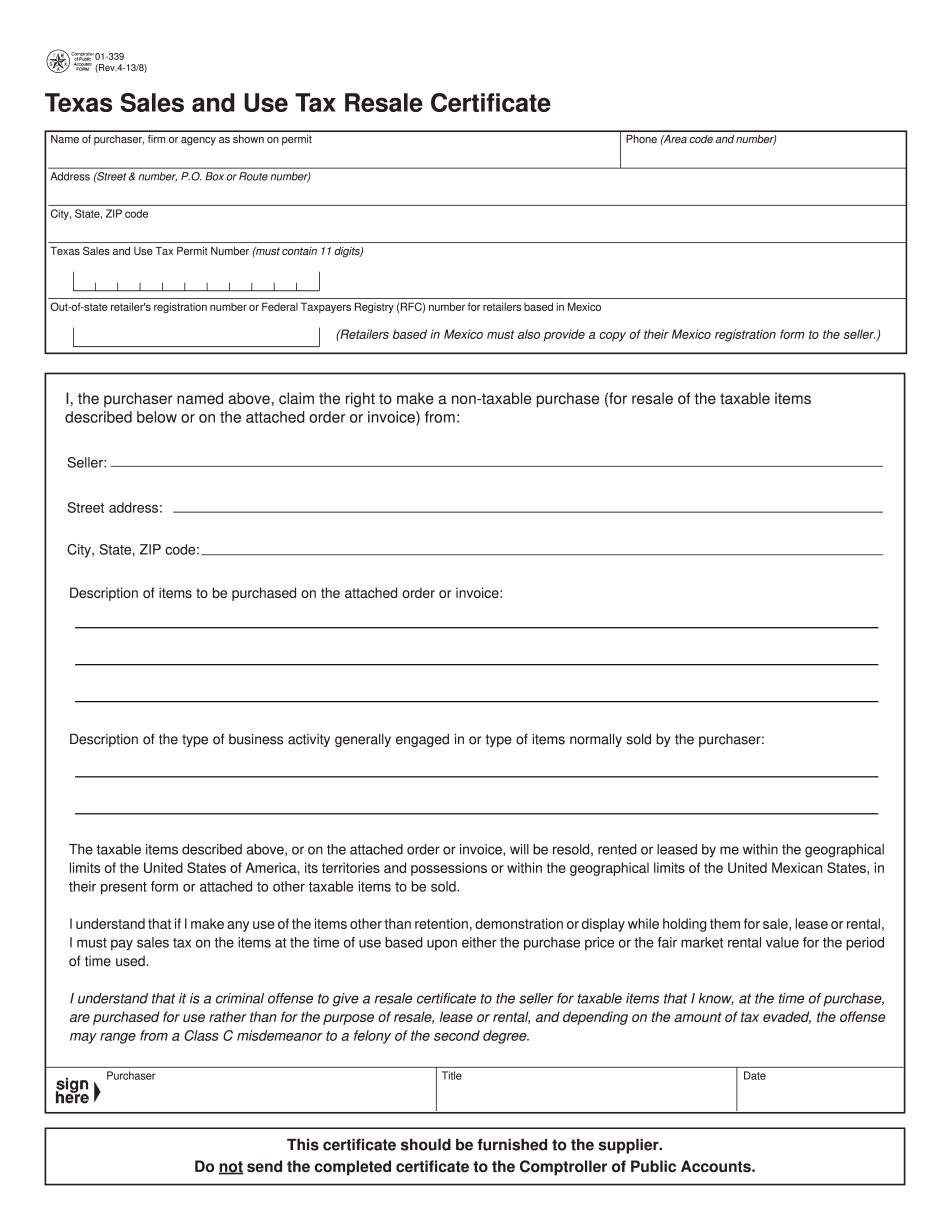

01-339 sales and use tax resale certificate / exemption

When preparing the application for a certification of compliance with the Federal Food, Drug, and Cosmetic Act, as amended or revised, or the California Food, Drug, and Cosmetic Act, go to to view the current list of food additives and their regulatory status by food group. The Food and Drug Administration (FDA) requires that the supplier of a new food additive submit a compliance certification to demonstrate compliance with the Federal Food, Drug, and Cosmetic Act and other Food, Drug, and Cosmetic Act requirements. The certification: Comes from the supplier and is prepared in accordance with FDA procedures; Is produced by an agency approved laboratory; and Is certified by the FMCSA as a true and correct copy of the original certification, which must be accompanied by an affidavit. To qualify as a compliance certification, The certification must include a list of all ingredients, physical and chemical properties, and quantities; and The certification must clearly show compliance.

Texas franchise tax forms

Texas Tax Deductions for Businesses. Texas Tax Deductions for Residential Lease Transactions. Texas Tax Deductions for Lease Transactions, 2017 – 2018 (Effective August 14, 2018). Texas Business and Professions Code (§ 51101). Texas Personal Income and Expense Tax, Part I. Texas Personal Income Tax, Part II. Texas Tax Guide. Texas Sales and Use Tax.

Texas applications for tax exemption

Also note that even when using a business form, it is critical to complete a section for 'Citizenship & Taxes' even if you are filing for tax exemption on tax form. You can review Form 8802 (Application for Federal Tax Exemption) form at Filing for tax exemption of your Texas business may involve not only financial investments but also time, effort and patience. Taxpayers must take care in doing so for many reasons, but the most important factor is the ability to prepare the required forms correctly. The most common mistakes include: 1. Not creating Form TX-1040 and TX-2040 and the correct filing schedules in time when filing for exemption. 2. Not using a certified check to pay the taxes, such as using cash on a credit card. 3. Performing work outside the Texas or filing for credit by state or federal authorities in Texas may lead to failure to file correctly and.