Award-winning PDF software

Tx Comptroller 01-339 2025 Form: What You Should Know

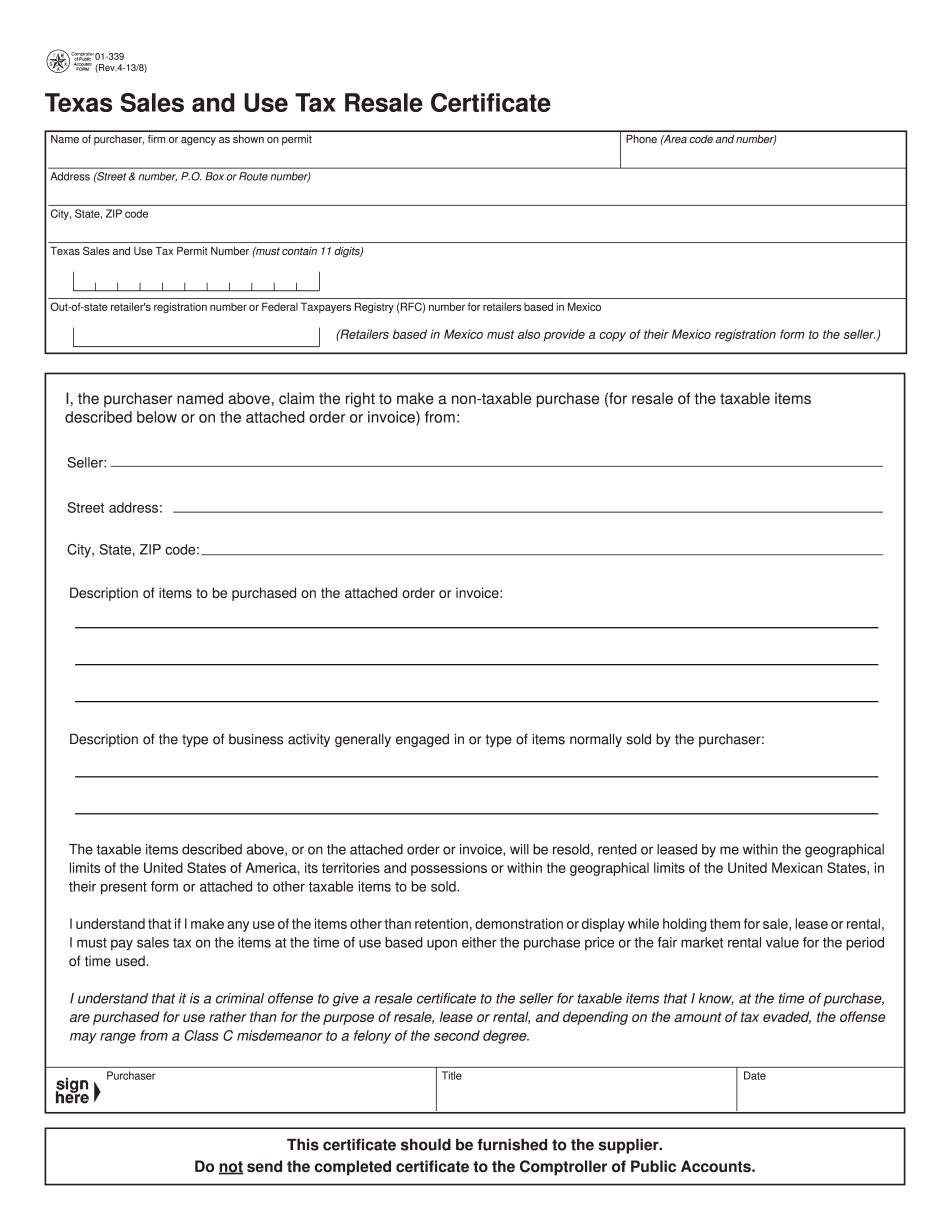

Address Telephone(s) Email(s) 01-339.051 (10/2013). Sales and use tax exemption for tangible personal property sold to persons with a disability. This form is used to provide a certificate that is to be presented to the Texas Department of Public Safety to complete the required sales tax exemption paperwork. (01-341, Sec. 1. (1).) 01-339.053, (05/2014). Sales and use tax exemption for real property for persons with a disability. (01-341, Sec. 7. (1/13 & Rev. 6-1/13) (10/2013).) 01-339.055, (02/2015). Sales and use tax exclusion for services provided to certain disabled elderly and certain persons whose incomes are less than 25,000 annually. (01-341, Secs. 7 (1), 10. (1), (3), (4) (20/2013); Rev. 8-11/13). 02-2021 Form TX Department of Public Safety Sales and Use Tax Exemption Request for Certification of Qualifying Disabled Person, as defined under Texas Business and Commerce Code, Sec. 1.101 (5). This form is used only by persons with a qualifying disability described in Sec. 1.101 (5). (02-2022 Sec. 2. (5) (1).) 02-2022.012,(02/2015). Sale of tangible personal property, tangible personal property sales for the use of disabled individuals and tangible personal property used to transport or provide services to or for individuals with disabilities. (02-2022 Sec.4. (5) (8); Rev.4-13/8 (2).) Texas Certification for Sales Tax Exemption This certification provides proof of sales tax exemption for certain sales. This form is used to qualify persons who qualify for the exemption. (01-340, Sec.1. (10).) 01-340 (Back). (10/2013). Sales tax exemption for tangible personal property sold to persons with a disability. (01-341, Pt. 6. (5).) Tangible personal property exemptions can extend to items like clothing, shoes, accessories and toys. (Back) Tangible Personal Property Exemption This is a certification that the purchaser of the item received a sales or use tax exemption for it.

Online methods enable you to to prepare your doc management and strengthen the productivity of your respective workflow. Abide by the quick tutorial so that you can entire TX Comptroller 01-339 2025 Form, keep away from glitches and furnish it in a timely method:

How to accomplish a TX Comptroller 01-339 2025 Form on the internet:

- On the web site aided by the type, click Begin Now and move towards the editor.

- Use the clues to complete the suitable fields.

- Include your personal information and facts and speak to knowledge.

- Make sure that you enter proper data and figures in best suited fields.

- Carefully check out the content of the kind in addition as grammar and spelling.

- Refer to aid portion for those who have any inquiries or handle our Service group.

- Put an digital signature on your own TX Comptroller 01-339 2025 Form along with the guidance of Signal Resource.

- Once the form is completed, push Carried out.

- Distribute the ready form by means of e-mail or fax, print it out or save in your unit.

PDF editor enables you to make alterations on your TX Comptroller 01-339 2025 Form from any net connected equipment, customize it as outlined by your requirements, indicator it electronically and distribute in different means.